CFD’er er komplekse instrumenter, og der er en stor risiko forbundet med disse for at miste penge på grund af gearing. 77.3 % af detailinvestorerne har tab på deres konto, når de handler CFD’er med denne udbyder. Du skal overveje, om du forstår, hvordan CFD’er fungerer, og om du har råd til at løbe en stor risiko for at miste dine penge.

Tirsdag Jun 17 2025 11:09

8 min

On Monday, 23 June, the UK Composite PMI Flash (June) will be released at 08:30 GMT, followed by the U.S. Composite PMI Flash (June) at 13:45 GMT. On Tuesday, 24 June, watch for the Canada Inflation Rate YoY (May) at 12:30 GMT and the U.S. CB Consumer Confidence (June) at 14:00 GMT, alongside earnings from FedEx (FDX).

On Wednesday, 25 June, the Australia Monthly CPI Indicator (May) will be published at 01:30 GMT, with Micron (MU) reporting earnings. Thursday, 26 June features the U.S. GDP Growth Rate QoQ Final (Q1) at 12:30 GMT and Japan Unemployment Rate (May) at 23:30 GMT, alongside earnings from Nike (NKE). On Friday, 27 June, both the U.S. Core PCE Price Index YoY (May) and Canada PPI YoY & GDP MoM (April) will be released at 12:30 GMT.

The UK S&P Global Composite PMI Flash recorded a reading of 50.3 in May, with the June estimate inching up slightly to 50.4. This modest improvement suggests expectations of continued, albeit fragile, economic expansion. The slight upward revision likely reflects cautious optimism, marginal improvement in business sentiment, and resilience in the services sector. However, the near-flat growth level also signals that broader economic momentum remains weak, with ongoing concerns about consumer demand and global uncertainties keeping expectations in check. This data is set to be released on 23 June at 0830 GMT.

The U.S. S&P Global Composite PMI Flash came in at 53.0 in May, with the June forecast slightly higher at 53.1. This marginal upward revision indicates expectations of steady and modest growth across both the manufacturing and services sectors. The slight improvement may reflect resilience in consumer spending and easing inflationary pressures, which together support stable business activity. Although not a significant jump, the expected uptick suggests that the U.S. economy remains on a path of moderate expansion despite global uncertainties and tighter monetary conditions. This data is set to be released on 23 June at 1345 GMT.

Canada’s inflation rate eased to 1.7% year-over-year in April, and it is expected to decline further to 1.5% in May. This projected drop reflects continued disinflationary trends driven by lower energy prices, base effects from last year’s elevated inflation, and softer consumer demand amid high interest rates. Additionally, stabilising supply chains and subdued wage pressures are contributing to a more moderate inflation environment, reinforcing expectations that price increases will remain within or even below the central bank’s target range. This data is set to be released on 24 June at 1230 GMT.

( Canada Inflation Rate YoY Chart , Source: Trading Central)

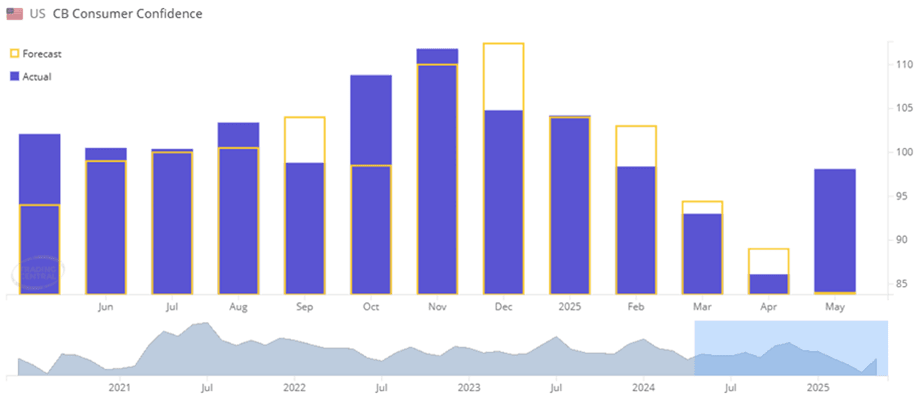

The U.S. Conference Board Consumer Confidence Index registered a reading of 98 in May, with the June forecast slightly lower at 97. This modest decline suggests that consumer sentiment may be softening amid lingering concerns over inflation, high interest rates, and economic uncertainty. Despite a strong labour market, households could be feeling the strain of persistent price pressures and elevated borrowing costs, which may be dampening optimism about future economic conditions. The slight dip reflects caution rather than a sharp downturn, indicating that while consumers remain relatively confident, they are growing more guarded in their outlook. This data is set to be released on 24 June at 1400 GMT.

( U.S. CB Consumer Confidence Chart , Source: Trading Central)

Top US company earnings: FedFx (FDX)

Australia’s Monthly CPI Indicator came in at 2.4% year-over-year in April, with the forecast for May slightly lower at 2.3%. This marginal decline suggests expectations of continued disinflation, likely driven by easing cost pressures in goods and energy, alongside softer domestic demand. While still above pre-pandemic norms, the slight drop indicates a steady return toward the RBA’s target range, supporting the case for a cautious monetary policy stance. This data is set to be released on 25 June at 0130 GMT.

( Australia Monthly CPI Indicator Chart, Source: Trading Central)

Top US company earnings: Micron (MU)

The U.S. GDP growth rate for Q4 2024 stood at 2.4% quarter-over-quarter, while the forecast for Q1 2025 has been revised down to -0.2%. This anticipated contraction signals growing concerns about a potential economic slowdown, likely stemming from the cumulative effects of tight monetary policy, weakening consumer demand, and reduced business investment. Elevated interest rates may be weighing on credit-sensitive sectors such as housing and manufacturing, while global uncertainties and cautious corporate spending could further dampen growth. This data is set to be released on 26 June at 1230 GMT.

( U.S. GDP Growth Rate QoQ Chart, Source: Trading Central)

Japan’s unemployment rate held steady at 2.5% in April, with the forecast for May also remaining unchanged at 2.5%. This stable outlook reflects expectations of continued labour market resilience amid modest economic growth. Japan's tight labour conditions, driven by an ageing population and shrinking workforce, have helped maintain low unemployment levels despite external headwinds. While broader economic challenges persist, including sluggish consumer demand and global uncertainties, employers appear to be retaining workers, suggesting a balanced labour market that supports the Bank of Japan’s cautious policy stance. This data is set to be released on 26 June at 2330 GMT.

( Japan Unemployment Rate Chart, Source: Trading Central)

Top US company earnings: Nike (NKE)

The U.S. Core PCE Price Index rose by 2.5% year-over-year in April, with the forecast for May slightly higher at 2.6%. This expected uptick suggests that underlying inflationary pressures remain persistent, particularly in services and housing-related components. The slight increase also reflects market concerns that inflation could stay above the Fed’s 2% target for longer, potentially influencing future interest rate decisions and keeping monetary policy tighter for an extended period. This data is set to be released on 27 June at 1230 GMT.

( U.S. Core PCE Price Index YoY Chart, Source: Trading Central)

Canada’s GDP growth for March was a modest 0.1% month‑on‑month, with April now expected to match that pace at roughly 0.1%. This steady outlook suggests a continuation of balanced economic activity, supported by strength in goods-producing sectors, particularly mining, oil and gas extraction, and steady contributions from services such as retail and transportation. This data is set to be released on 27 June at 1230 GMT.

( Canada GDP MoM Chart, Source: Trading Central)

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.