How much will $1 Bitcoin be worth in 2030: Bitcoin, as the pioneering digital currency, has captured the imagination of many around the world.

Since its inception, it has evolved beyond just a novel technology—becoming a symbol of decentralized finance and a new form of digital asset. Looking ahead to 2030, the future value of Bitcoin is a topic of wide discussion and speculation. While precise figures cannot be predicted, understanding the factors that could influence its worth provides a meaningful perspective on what may lie ahead.

Bitcoin has transformed from a niche digital experiment into a widely recognized asset class. Its underlying blockchain technology has paved the way for countless innovations, and its decentralized nature challenges traditional concepts of money and finance.

By 2030, Bitcoin’s role in the global economy may be very different from today. It could be integrated more deeply into everyday commerce, or it might serve as a key component of digital financial systems. Alternatively, it could remain primarily a store of value or a digital collectible with broad recognition.

Adoption and Usage

The extent to which Bitcoin is adopted for transactions, savings, or as a medium of exchange will heavily influence its utility and perception. Greater adoption by individuals, companies, and institutions worldwide could enhance its demand.

Widespread usage depends on factors such as user-friendly platforms, regulatory clarity, and acceptance by merchants and service providers. If Bitcoin becomes easier to use and more integrated into everyday financial activities, its relevance and worth could increase.

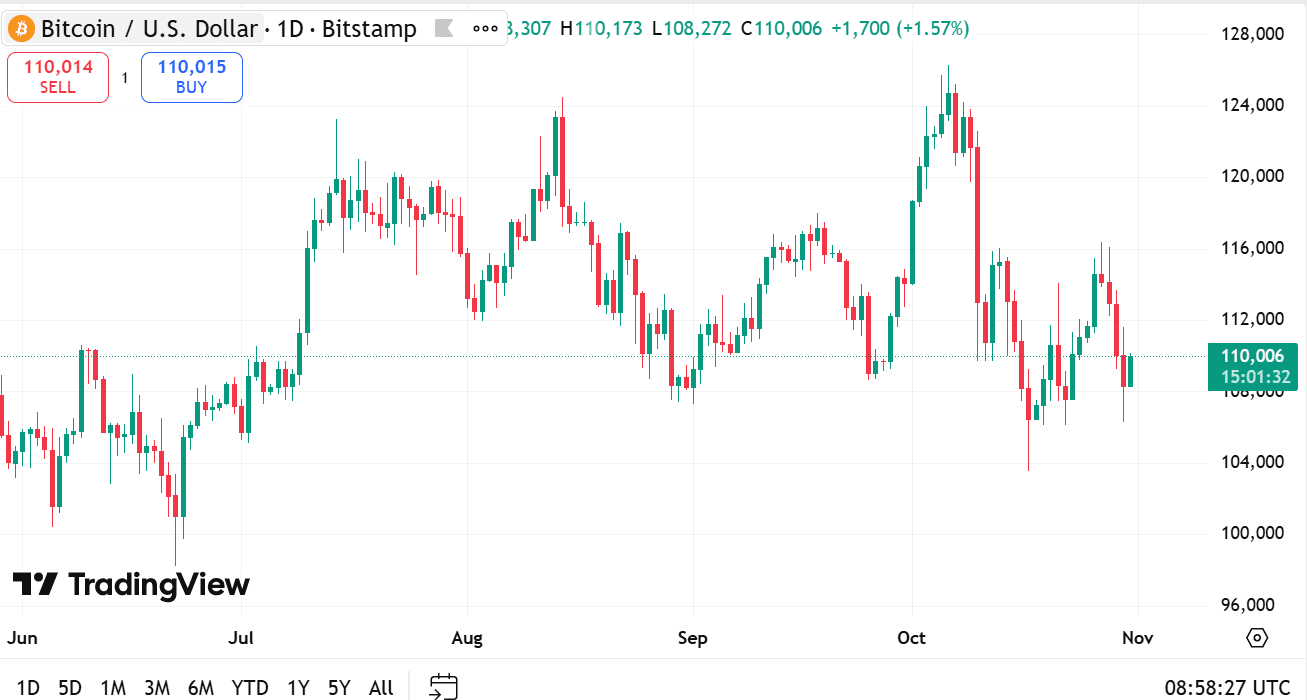

source: tradingview

Regulatory Landscape

Regulation will play a pivotal role in shaping Bitcoin’s trajectory. Governments and regulatory bodies worldwide are still defining how to approach digital currencies. Clear, consistent frameworks that balance innovation with oversight could foster confidence.

Conversely, restrictive policies or bans in major economies may limit Bitcoin’s accessibility and reduce its global reach. The evolution of regulation will also affect how Bitcoin interacts with traditional financial systems and whether it gains broader legitimacy.

Technological Developments

Bitcoin’s underlying technology continues to evolve. Improvements in scalability, transaction speed, and energy efficiency could enhance its usability and reduce barriers to entry.

Advancements in related technologies, like layer-two solutions and interoperability with other blockchains, may also expand Bitcoin’s ecosystem. These changes could make Bitcoin more practical for daily use and increase its adoption globally.

Competition from Other Digital Assets

The digital currency landscape is diverse and continuously expanding. Other cryptocurrencies and digital assets offer various features and use cases that compete with Bitcoin.

While Bitcoin is often seen as the original and most established digital asset, the rise of alternative technologies and platforms could influence its market position. How Bitcoin evolves relative to these competitors will impact its perceived value.

Inflation and Currency Dynamics

Global economic conditions, including inflation trends and currency stability, can influence Bitcoin’s appeal. In environments where traditional currencies face challenges, Bitcoin’s decentralized nature might offer an alternative.

However, the relationship between macroeconomic factors and Bitcoin is complex and subject to change. Its behavior in diverse economic scenarios will help shape its long-term narrative.

Geopolitical Considerations

Political developments and global relations affect financial markets broadly, including digital assets. Bitcoin’s borderless and decentralized qualities mean it interacts uniquely with geopolitical events.

Increased geopolitical uncertainty might affect demand for digital assets, but this depends on how participants perceive Bitcoin relative to other options. The global political climate will remain a key factor in shaping Bitcoin’s future.

Scenario 1: Mainstream Digital Asset

In this scenario, Bitcoin becomes a widely accepted digital asset integrated into financial systems worldwide. It serves as a global medium of exchange and store of digital value.

Technological improvements and regulatory clarity support everyday use. Many individuals and companies hold and transact Bitcoin regularly, and it’s seamlessly integrated into payment networks and financial services.

Scenario 2: Digital Gold Alternative

Here, Bitcoin retains its role primarily as a digital store of value. It is viewed as a reliable means to preserve wealth outside traditional financial systems, especially in uncertain times.

Its usage for daily transactions remains limited, but its scarcity and decentralized nature maintain demand. It acts as a hedge against certain economic risks, with growing recognition as a complementary asset.

Scenario 3: Niche or Specialized Asset

Bitcoin’s role narrows to a specialized digital asset with limited mainstream adoption. Competing digital currencies and technologies dominate areas like payments, contracts, or decentralized finance.

Bitcoin remains popular among enthusiasts and certain communities but loses ground in broader financial applications. Its value experiences fluctuations tied closely to market interest and technological developments.

Several challenges could affect Bitcoin’s path forward:

The journey of Bitcoin over the next several years will be shaped by a dynamic mix of adoption trends, regulatory decisions, technological advances, and global economic forces. Its future worth will reflect how these factors interact and the evolving roles Bitcoin plays in the global financial ecosystem.

While exact predictions are elusive, Bitcoin’s unique characteristics and growing integration into financial systems suggest it will remain a key digital asset by 2030. Whether it becomes a universal medium of exchange, a digital store of value, or a niche asset depends on developments both within and beyond the blockchain space.

Regardless of the specific outcome, Bitcoin’s influence on finance and innovation is likely to continue expanding, making it an important part of the digital economy in the years ahead.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.