We use cookies to do things like offer live chat support and show you content we think you’ll be interested in. If you’re happy with the use of cookies by markets.com, click accept.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Monday May 18 2020 10:12

1 min

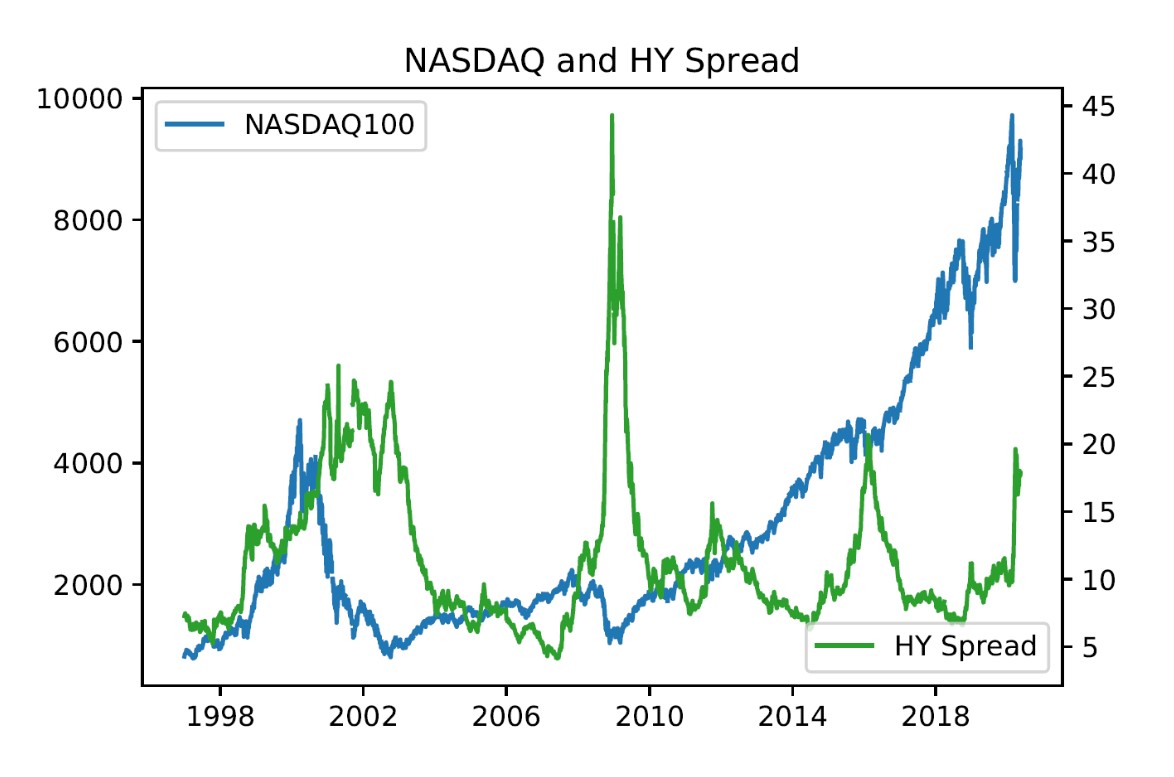

Over the last 8 weeks, the NASDAQ has rallied as much as 40%, from its lows on 23 March to a swing high at the beginning of last week.

However, an analysis of the performance of high-yield corporate debt during the current equity market rally, as compared to how high-yield debt has performed in past bear markets, may indicate to traders that continued caution is warranted.

This is because, while the NASDAQ rallied from lows at 6,633 to highs above 9,353, the high-yield spread has only tightened from a recent high of 19.62% to 17.85% on Friday.

The high-yield spread we have considered is the difference between corporate debt below investment grade and government debt.

Historically, we have seen a seen a much greater tightening of spreads when looking at the end of bear markets, such as those that originated during the dotcom bubble crash and the 2008 global financial crisis, compared to what we have seen now.

Instead, what we are seeing now, with spreads remaining high, may look more like a bear market rally rather than the sustained equity bull market uptrend seen when credit spreads have moved markedly lower.

Asset List

View Full ListLatest

View all

Thursday, 8 May 2025

6 min

Thursday, 8 May 2025

5 min

Wednesday, 7 May 2025

6 min