You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

रविवार मई 25 2025 06:00

6 मिनट

1. Monday, 26 May 2025: No Important Events Due to Bank Holiday

2. Tuesday, 27 May 2025: [12:30 GMT] U.S. Durable Goods Orders MoM

4. Thursday, 29 May 2025: [12:30 GMT] U.S. GDP Growth Rate QoQ, [23:30 GMT] Japan Unemployment Rate

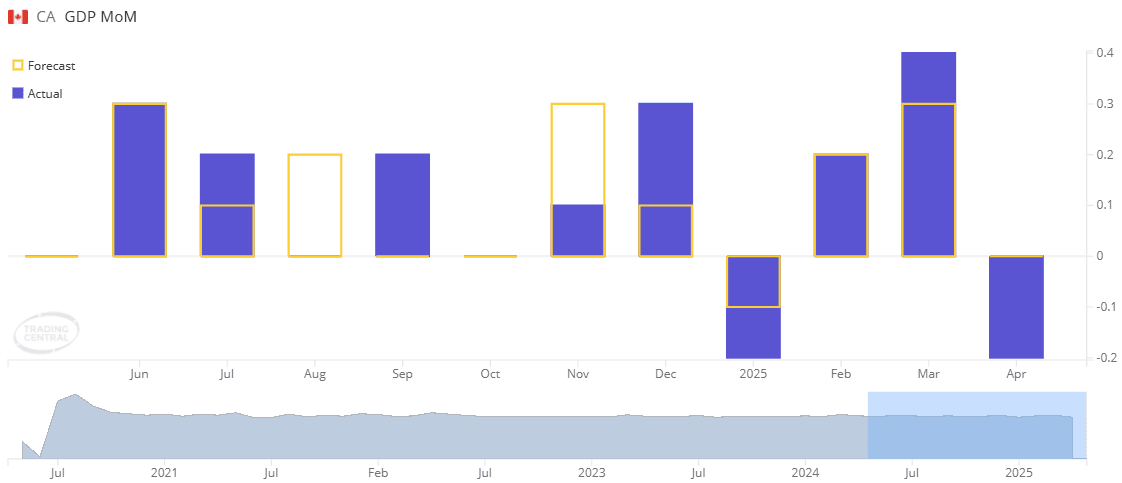

5. Friday, 30 May 2025: [12:30 GMT] U.S. Core PCE Price Index YoY, [12:30 GMT] Canada GDP MoM

On Tuesday, 27 May at 12:30 GMT, U.S. durable goods orders are forecast to drop 6.8% in April, following a sharp 7.5% gain in March. This is likely due to a correction from one-off large orders and softer business sentiment. On Wednesday, 28 May, Australia's CPI (01:30 GMT) is expected to ease to 2.1%, reflecting cooling demand, while the RBNZ (02:00 GMT) may cut rates to 3.25% due to slowing growth.

On Thursday, 29 May, the U.S. GDP (12:30 GMT) is expected to contract by -0.3%, and Japan’s unemployment (23:30 GMT) is forecast to hold steady at 2.5%. On Friday, 30 May at 12:30 GMT, U.S. Core PCE is expected to rise to 2.7% YoY and 0.2% MoM, while Canada’s GDP may rebound to 0.1%, indicating a slight economic recovery.

U.S. durable goods orders rose sharply by 7.5% month-over-month in March, but April's figure is expected to decline by 6.8%. This anticipated drop likely reflects a correction following the unusually strong surge in March, which may have been driven by one-off factors such as large aircraft or defence-related orders. Durable goods data is often volatile, and sharp monthly swings are not uncommon. Additionally, tighter financial conditions and waning business investment sentiment amid ongoing economic uncertainty may contribute to softer demand for big-ticket items in April. This data is set to be released on 27 May at 1230 GMT.

(U.S. Durable Goods Orders MoM Chart, Source: Trading Central)

Top US company earnings: Xiaomi (XIACY), Bank of Nova Scotia (BNS)

Australia’s monthly CPI inflation was 2.4% in March, with April expected to ease slightly to 2.1%. The anticipated moderation likely reflects easing price pressures as supply chain disruptions improve and energy costs stabilise. Additionally, the Reserve Bank of Australia’s recent rate hikes may be starting to temper consumer demand, contributing to slower inflation growth in April. This data is set to be released on 28 May at 0130 GMT.

(Australia Monthly CPI Indicator Chart, Source: Trading Central)

The Reserve Bank of New Zealand (RBNZ) last held its interest rate steady at 3.5%, but the upcoming meeting is widely expected to see a cut to 3.25%. This anticipated easing reflects growing concerns about slowing economic growth and subdued inflation pressures, prompting the central bank to adopt a more accommodative stance to support activity. Additionally, external uncertainties and softer domestic demand have likely influenced expectations for a rate reduction to help sustain recovery. This data is set to be released on 28 May at 0200 GMT.

(RBNZ Interest Rate Decision Chart, Source: Trading Central)

Top US company earnings: Nvidia (NVDA), Salesforce Inc (CRM)

The U.S. economy grew by 2.4% quarter-over-quarter in the previous quarter, but the upcoming GDP release is expected to show a contraction of -0.3%. This projected decline likely reflects the lagging effects of tighter monetary policy, with high interest rates weighing on consumer spending, business investment, and credit growth. Additionally, persistent inflation and global economic uncertainty may have further dampened economic activity, raising the risk of a temporary slowdown or technical recession. This data is set to be released on 29 May at 1230 GMT.

(U.S. GDP Growth rate QoQ Chart, Source: Trading Central)

Japan's unemployment rate held steady at 2.5% in March, and it is expected to remain unchanged at 2.5% in April. This stability reflects the continued tightness in Japan’s labour market, supported by structural factors such as an ageing population and a declining workforce. Despite global economic uncertainties, domestic employment conditions have remained resilient, with companies retaining workers amid labour shortages and steady demand in key sectors like services and manufacturing. This data is set to be released on 29 May at 2330 GMT.

(Japan Unemployment Rate QoQ Chart, Source: Trading Central)

Top US company earnings: RBC (RY), Dell Tech (DELL)

The U.S. Core PCE Price Index rose 2.6% year-over-year and was flat month-over-month in March, but for April, it is expected to increase to 2.7% YoY and 0.2% MoM. The slight uptick in the annual figure likely reflects base effects and persistent inflationary pressures in key services sectors such as housing, healthcare, and insurance. The expected monthly rise suggests a modest rebound in price momentum after a flat reading in March, driven by seasonal factors, steady consumer demand, and ongoing wage growth. This data is set to be released on 30 May at 1230 GMT.

(U.S. Core PCE Price Index YoY Chart, Source: Trading Central)

Canada's GDP contracted by 0.2% month-over-month in February, but growth is expected to rebound slightly to 0.1% in March. This anticipated improvement likely reflects a recovery in key sectors such as manufacturing, retail, and services following temporary disruptions earlier in the year. The negative print in February may have been influenced by adverse weather conditions or supply chain issues, and the modest expected gain in March suggests a return to more stable economic activity, supported by resilient consumer spending and steady domestic demand. This data is set to be released on 30 May at 1230 GMT.

(Canada GDP MoM Chart, Source: Trading Central)

Top US company earnings: Costco (COST), Cresco Labs (CRLBF)

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.