You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

목요일 Aug 21 2025 06:40

5 분

Gold prices slipped to around $3,340 per ounce on Thursday as investors positioned themselves ahead of the three-day Federal Reserve Jackson Hole symposium, starting later today. Market focus is on Fed Chair Jerome Powell’s remarks for clues about future monetary policy. Traders are currently pricing in an 85% probability of a September rate cut. However, the latest Fed minutes revealed lingering concerns over inflation and the labour market, with most policymakers judging it too soon to ease rates.

On the geopolitical front, Russia warned on Wednesday that addressing Ukraine’s security concerns without its participation would be a “road to nowhere,” sending a clear message to the West as it seeks to secure Kyiv’s future protection.

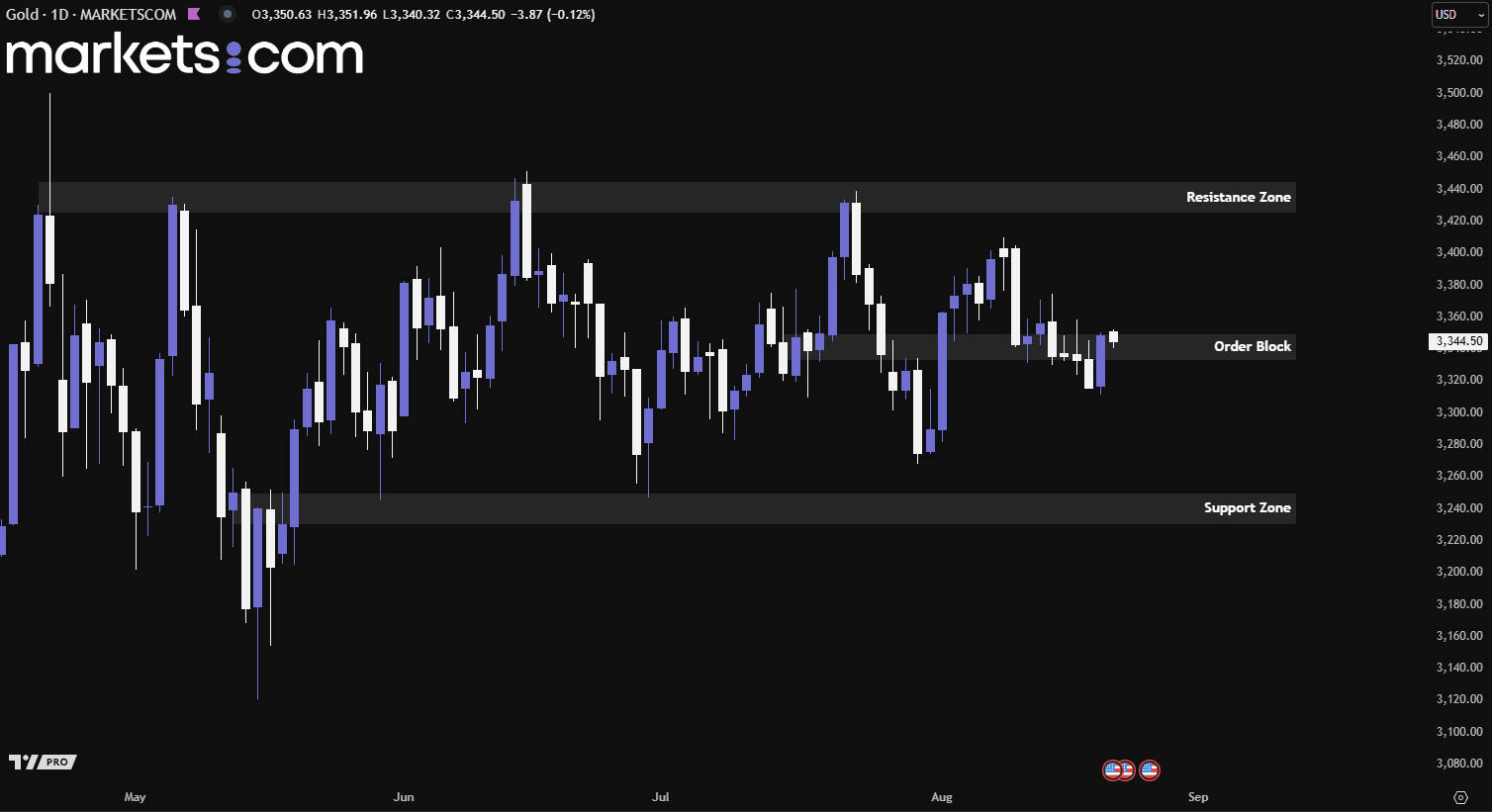

(Gold Daily Price Chart, Source: Trading View)

From a technical analysis perspective, the gold price has been moving in a consolidation phase since May 2025, with no significant trend moving in a single direction. Currently, the price is retesting within the order block of 3,333 – 3,350. If this zone fails to hold the price, it might potentially drive lower to retest the support zone of 3,230 – 3,250. Conversely, if it can find support from this zone, it might experience bullish momentum and surge upwards.

The U.K. flash manufacturing PMI stood at 48.0 in July, with August expected to edge slightly higher at 48.6, indicating a modest recovery but remaining in contraction territory. This slight improvement is likely supported by better supply chain conditions and a small uptick in orders, though overall manufacturing activity continues to face headwinds.

Meanwhile, the flash services PMI came in at 51.8 in July and is projected to ease marginally to 51.7 in August, suggesting the sector remains in expansion but with slower momentum. This minor dip reflects softer domestic demand and ongoing cost pressures, pointing to uneven growth across the U.K. economy as manufacturing lags services. This data is set to be released today at 0830 GMT.

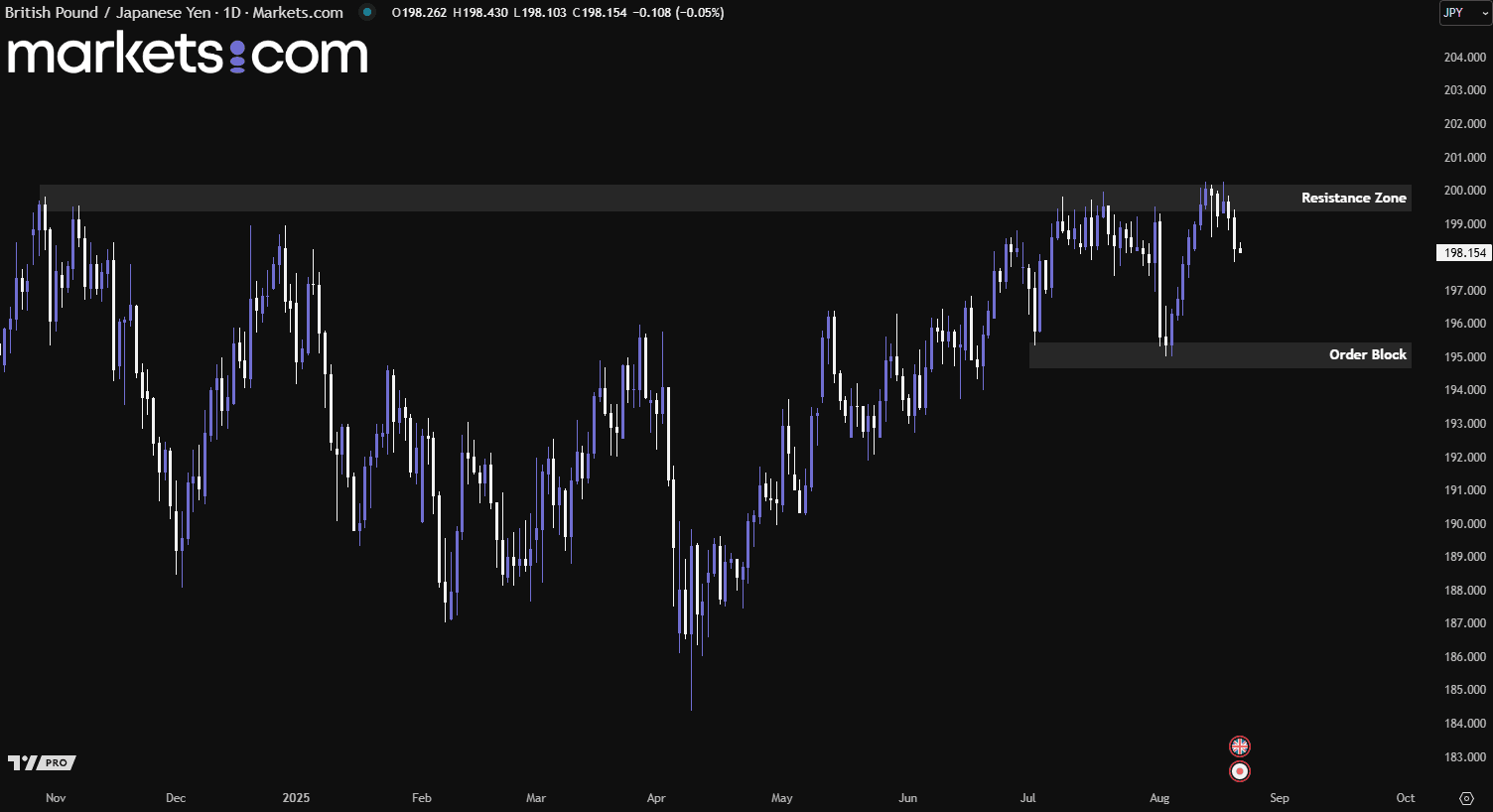

(GBP/JPY Daily Chart, Source: Trading View)

From a technical analysis perspective, the GBP/JPY currency pair was recently rejected from the resistance zone of 199.40 – 200.20, driving it lower. This rejection may indicate an exhaustion of bullish momentum, with bearish momentum potentially taking over. Therefore, the pair could potentially decline further to retest the order block at 194.70 – 195.40.

Walmart Inc. (WMT) is set to release its fiscal 2025 second-quarter earnings today before the market opens, prompting investors to consider whether to buy ahead of the announcement or hold their positions. The retail giant continues to benefit from its diversified business model and omnichannel strategy, supported by steady traffic growth in both stores and online platforms. Expanding high-margin segments such as advertising and membership services further strengthens its ability to deliver stable growth.

The forecast for second-quarter revenues is $175.5 billion, up 3.7% year-over-year, while earnings are expected at 73 cents per share, reflecting a 9% annual increase. Notably, the earnings estimate has been revised up by a penny in the past week, signalling improved sentiment ahead of the report.

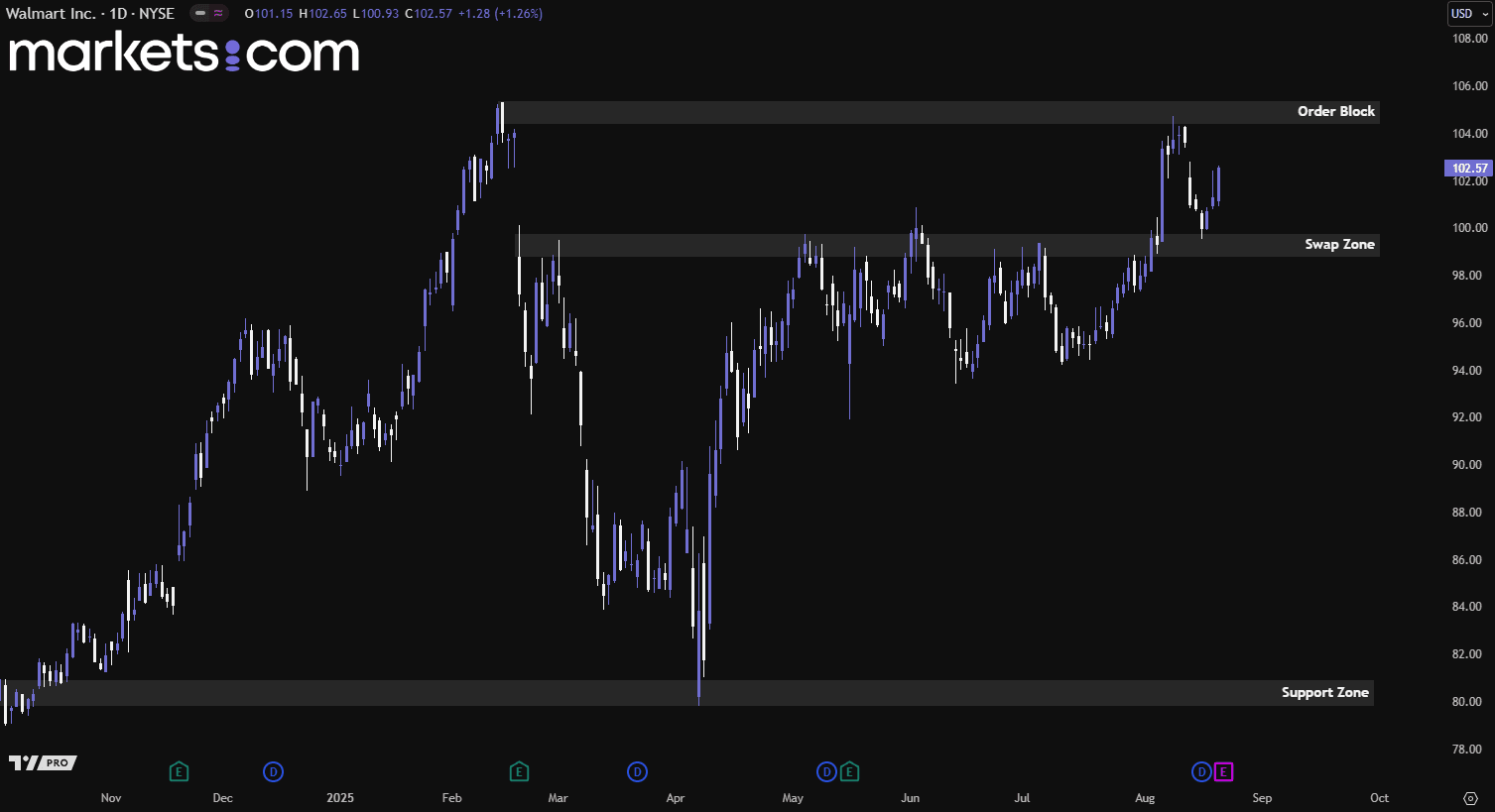

(Walmart Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, the Walmart share price broke above the swap zone of 99 – 100 in early August 2025, then surged upward but was rejected at the order block of 104.40 – 105.40, driving it lower. It later found support at the swap zone, which continued to fuel the bullish momentum and pushed the price higher, potentially setting up a move to retest the order block.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.