You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Miyerkules Jun 4 2025 08:01

9 min

1. Monday, 9 June 2025: [01:30 GMT] China Inflation Rate YoY, [03:00 GMT] China Balance of Trade

2. Tuesday, 10 June 2025: [06:00 GMT] U.K. Unemployment Rate, [23:50 GMT] Japan PPI YoY

3. Wednesday, 11 June 2025: [12:30 GMT] U.S. Inflation Rate YoY

4. Thursday, 12 June 2025: [06:00 GMT] U.K. GDP MoM, [12:30 GMT] U.S. PPI YoY

A busy week of key economic data kicks off on Monday, 9 June, with China’s inflation rate (01:30 GMT) and trade balance (03:00 GMT). Inflation is expected to fall slightly further to -0.2% YoY, reflecting ongoing deflationary pressures amid weak demand and property market challenges. Meanwhile, the trade surplus is forecast to narrow to 70 billion yuan due to softer global demand and rising imports. On Tuesday, 10 June, the U.K. unemployment rate (06:00 GMT) is expected to remain flat at 4.5% amid tight labour conditions and economic uncertainty, while Japan’s PPI (23:50 GMT) is projected to ease to 3.4%, signalling reduced input cost pressures from global commodities.

Midweek, the focus shifts to the U.S., starting with the May inflation rate (12:30 GMT, Wednesday, June 11), which is expected to tick up to 2.6% due to rising energy prices and sticky service inflation. On Thursday, 12 June, U.K. GDP (06:00 GMT) is forecast to slow to 0.1% MoM, while U.S. PPI (12:30 GMT) is expected to edge higher to 2.6%, driven by rising costs and demand. The week ends on Friday, 13 June, with Eurozone industrial production (09:00 GMT) likely to contract by -1.8% after a sharp March rise, and U.S. Michigan Consumer Sentiment (14:00 GMT) expected to improve slightly to 55, reflecting cautious optimism among American consumers.

China's year-over-year inflation rate for April came in at -0.1%, and the forecast for May is slightly lower at -0.2%. This downward revision reflects persistent deflationary pressures in the economy, driven by weak domestic demand, sluggish consumer spending, and ongoing challenges in the property sector. Despite government efforts to stimulate growth, subdued economic activity and falling producer prices continue to weigh on overall price levels, prompting expectations of a deeper decline in the inflation rate for May. This data is set to be released on 9 June at 0130 GMT.

(China Inflation Rate YoY Chart , Source: Trading Central)

China's trade surplus for April stood at 96.18 billion yuan, while the forecast for May has been revised down to 70 billion yuan. This anticipated decline is likely due to softer global demand, particularly from key export markets, as well as potential seasonal fluctuations in trade activity. Additionally, a modest recovery in domestic consumption may have led to increased imports, narrowing the overall trade balance. Geopolitical uncertainties and lingering effects of global supply chain adjustments could also be contributing to the more conservative trade surplus projection for May. This data is set to be released on 9 June at 0300 GMT.

(China Balance of Trade Chart , Source: Trading Central)

The U.K. unemployment rate for March was 4.5%, and the expected rate for April is projected to remain steady at 4.5% or possibly edge slightly higher. This outlook reflects ongoing economic uncertainty, particularly amid elevated interest rates and slowing business activity, which may be limiting new hiring. While some sectors have shown resilience, the labour market remains relatively tight; however, signs of softening suggest that the unemployment rate is unlikely to improve significantly in the short term. This data is set to be released on 10 June at 0600 GMT.

(U.K. Unemployment Rate Chart , Source: Trading Central)

Japan's Producer Price Index (PPI) rose 4% year-over-year in April, but the expected figure for May is lower at 3.4%. This projected decline suggests easing cost pressures at the wholesale level, likely due to stabilising global commodity prices and a stronger yen, which reduces import costs. Additionally, slowing external demand and a more moderate pace of domestic economic activity are contributing to a reduction in input price growth. These factors support the expectation of a softer PPI reading for May. This data is set to be released on 10 June at 2350 GMT.

(Japan PPI YoY Chart , Source: Trading Central)

Top US company earnings: GameStop Corp (GME)

The U.S. year-over-year inflation rate for April was 2.3%, with the expected rate for May rising to 2.6%. This anticipated increase reflects a combination of factors, including higher energy prices, resilient consumer spending, and potential base effects from lower price levels in the same period last year. Additionally, persistent service sector inflation, particularly in housing and healthcare, continues to exert upward pressure on overall prices. These dynamics contribute to the forecasted uptick in the May inflation rate. This data is set to be released on 11 June at 1230 GMT.

(U.S. Inflation Rate YoY Chart, Source: Trading Central)

Top US company earnings: Inditex ADR (IDEXY)

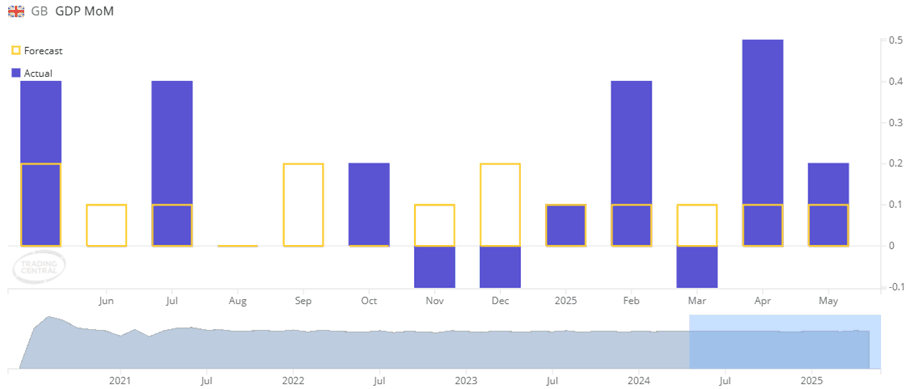

The U.K.'s month-over-month GDP growth for March was 0.2%, and the expected figure for April is a more modest 0.1%. This softer outlook reflects the impact of continued high interest rates, which are weighing on consumer spending and business investment. Additionally, slower growth in key sectors such as manufacturing and construction, along with lingering post-Brexit trade frictions, may be dampening economic momentum. This data is set to be released on 12 June at 0600 GMT.

(U.K. GDP MoM Chart, Source: Trading Central)

The U.S. Producer Price Index (PPI) rose 2.4% year-over-year in April, and the expected figure for May is slightly higher at 2.6%. This anticipated increase is likely driven by rising energy and commodity costs, as well as ongoing supply chain adjustments and steady demand in certain sectors. Additionally, upward pressure from service-related input costs may be contributing to the higher forecast. These factors suggest that producer-level inflation remains persistent, justifying the modest uptick expected for May. This data is set to be released on 12 June at 1230 GMT.

( U.S. PPI YoY Chart, Source: Trading Central)

Top US company earnings: Adobe (ADBE)

Eurozone industrial production rose by 2.6% month-over-month in March, but the expected figure for April is a decline of -1.8%. This anticipated drop reflects the likelihood of a correction following March's unusually strong rebound, which may have been driven by temporary factors such as inventory restocking or a weather-related boost. Additionally, continued weakness in external demand, high energy costs, and sluggish manufacturing activity across key member states suggest softer output in April, supporting the expectation of a month-over-month contraction. This data is set to be released on 13 June at 0900 GMT.

(Eurozone Industrial Production MoM Chart, Source: Trading Central)

The U.S. Michigan Consumer Sentiment Preliminary Index for May came in at 52.2, with the expected value for June rising to 55. This projected improvement reflects growing optimism among consumers, likely driven by easing inflation concerns, a resilient labour market, and stable wage growth. While sentiment remains historically low, the slight uptick suggests that consumers may be feeling cautiously more confident about their financial outlook and the broader economy heading into the summer months. This data is set to be released on 13 June at 1400 GMT.

(U.S. Michigan Consumer Sentiment Preliminary Chart, Source: Trading Central)

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.