You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

วันพุธ Jul 23 2025 07:31

5 นาที

U.S. stock futures edged higher on Wednesday following President Trump’s announcement of a new trade deal with Japan, which includes a 15% tariff on Japanese exports. Investors are also awaiting key earnings releases later today from tech heavyweights Tesla and Alphabet, along with results from Hasbro, Chipotle, and Mattel. On the economic front, existing home sales data is due, offering fresh insight into the housing market.

In Tuesday’s session, the Dow rose 0.4% and the S&P 500 added 0.06%, while the Nasdaq Composite slipped 0.39%, dragged down by chip stocks. Nvidia fell 2.4% and Broadcom dropped 3.3% amid reports that SoftBank and OpenAI’s joint AI venture had stalled. Sentiment was also dampened by disappointing earnings, with Lockheed Martin plunging 10.8%, Philip Morris down 8.2%, and General Motors sliding 8% after warning of deeper profit impacts from tariffs.

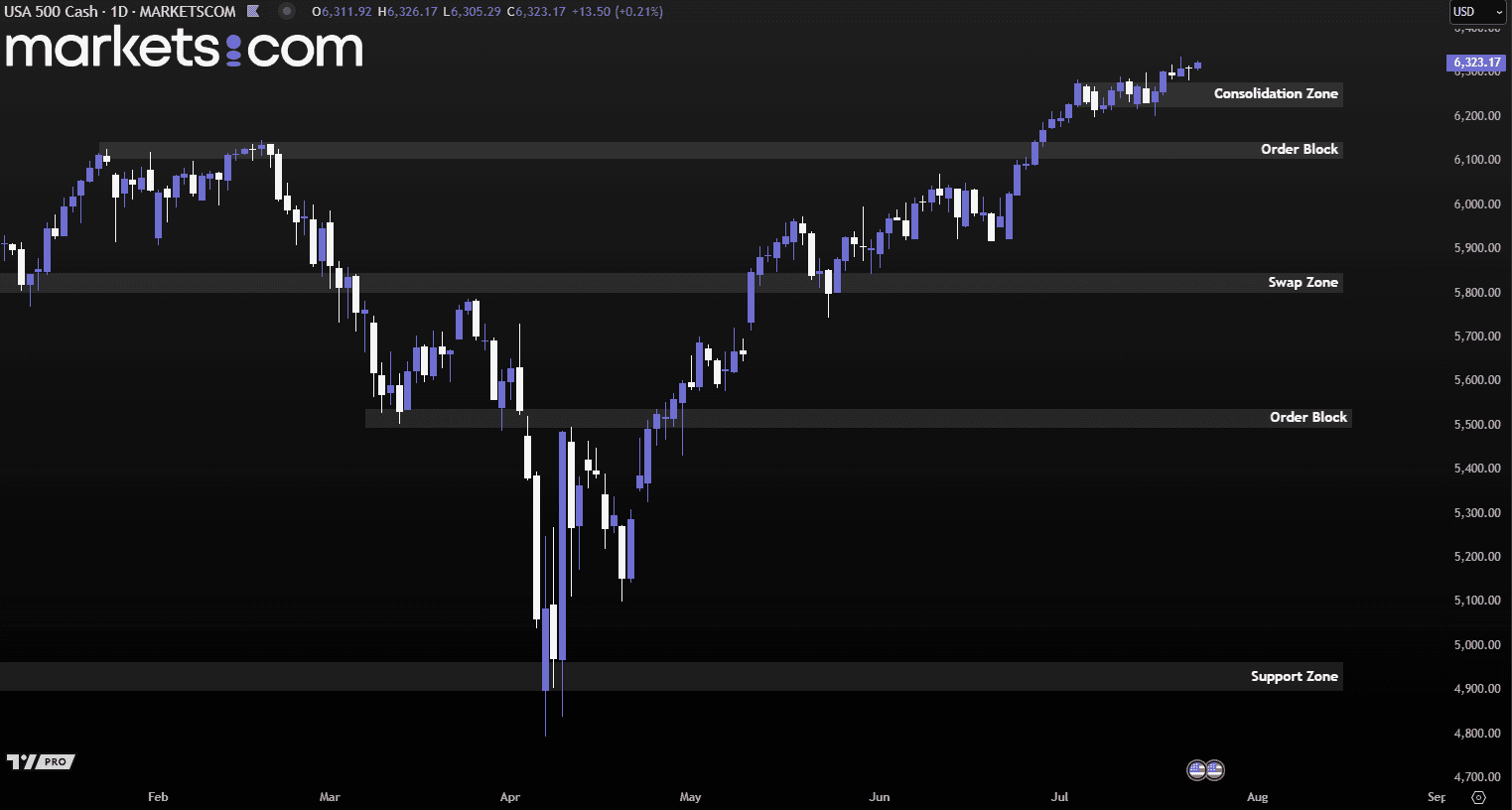

(S&P 500 Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the S&P 500 index has been in a bullish trend since April 2025, as evidenced by a series of higher highs and higher lows. Recently, it broke above the consolidation zone of 6,220 – 6,280 with strong bullish momentum, indicating that bullish forces remain intact. This valid bullish structure may potentially continue to drive the index higher.

The United States and Japan have reached a trade agreement that averts the steep tariffs previously threatened by President Donald Trump. As part of the deal, Japan committed to investing $550 billion in the U.S., a move seen as strengthening bilateral economic ties.

Under the agreement, a 15% tariff will be applied to all Japanese imports, down from the initially proposed 25%. This marks one of the most substantial trade deals secured by the White House ahead of the August 1 deadline, when broader tariff hikes were set to take effect.

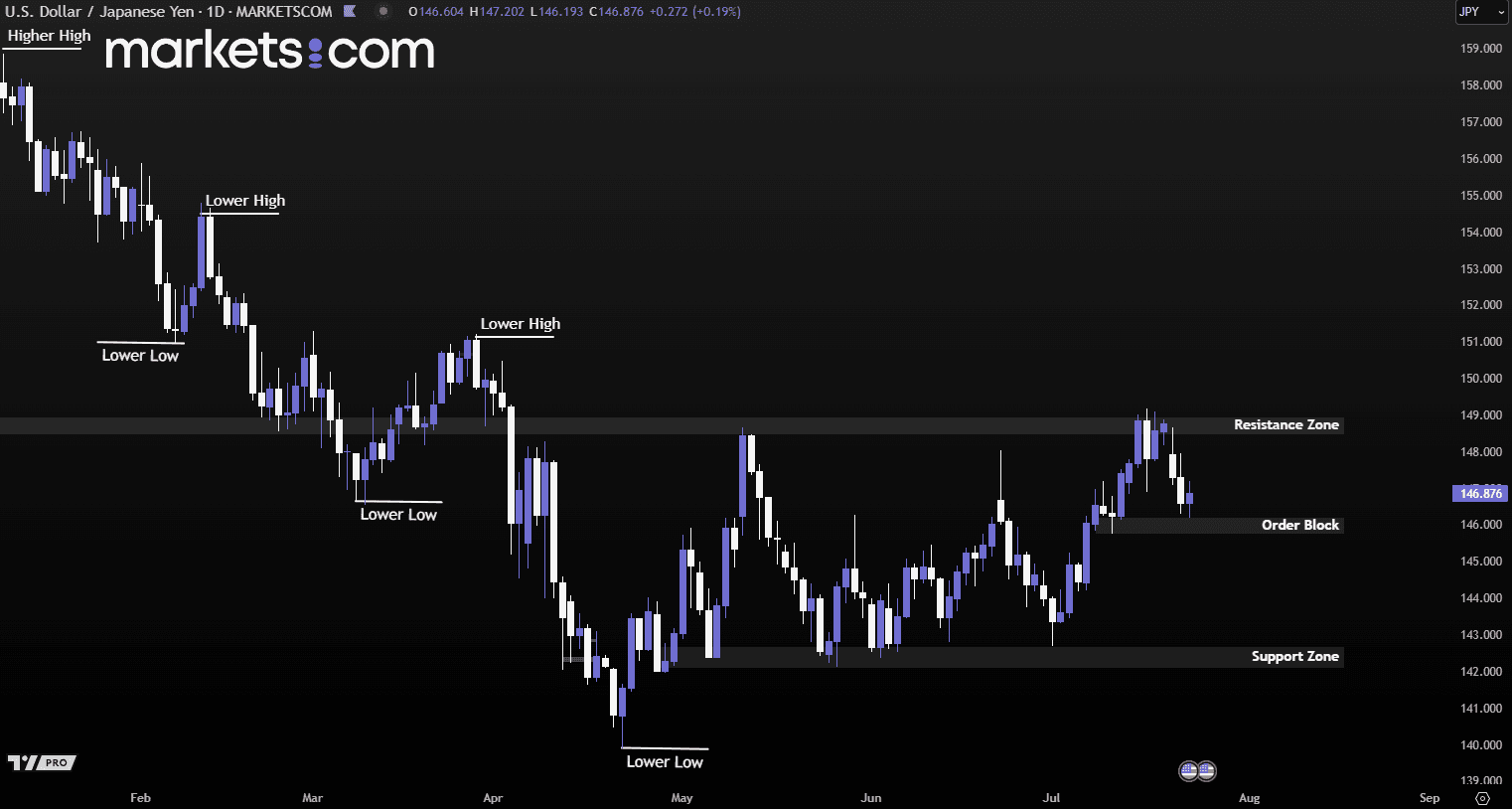

(USD/JPY Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/JPY currency pair has been rejected from the resistance zone of 148.50 – 149.00, pushing the pair downward. It is nearing the order block of 145.70 – 146.20 at the time of writing. If the pair finds support in this zone, it could potentially form a higher low and resume its upward movement. Conversely, if bearish momentum drives the pair below this order block, it may continue to fall toward the next support zone at 142.10 – 142.70.

Oil prices extended their decline as global supply continued to rise, while traders awaited clarity on whether U.S. President Donald Trump would act on his threat to impose new tariffs on trading partners starting August 1. Despite previous warnings, Trump has often held back on executing promised tariff hikes, adding uncertainty to market sentiment.

The drop in oil prices is further driven by concerns over weakening global demand amid slowing economic growth. OPEC+ has steadily increased output, restoring 2.2 million barrels per day to the market through three monthly additions of 411,000 bpd and is set to add another 548,000 bpd on August 1. The growing supply against a backdrop of fragile demand is putting downward pressure on prices.

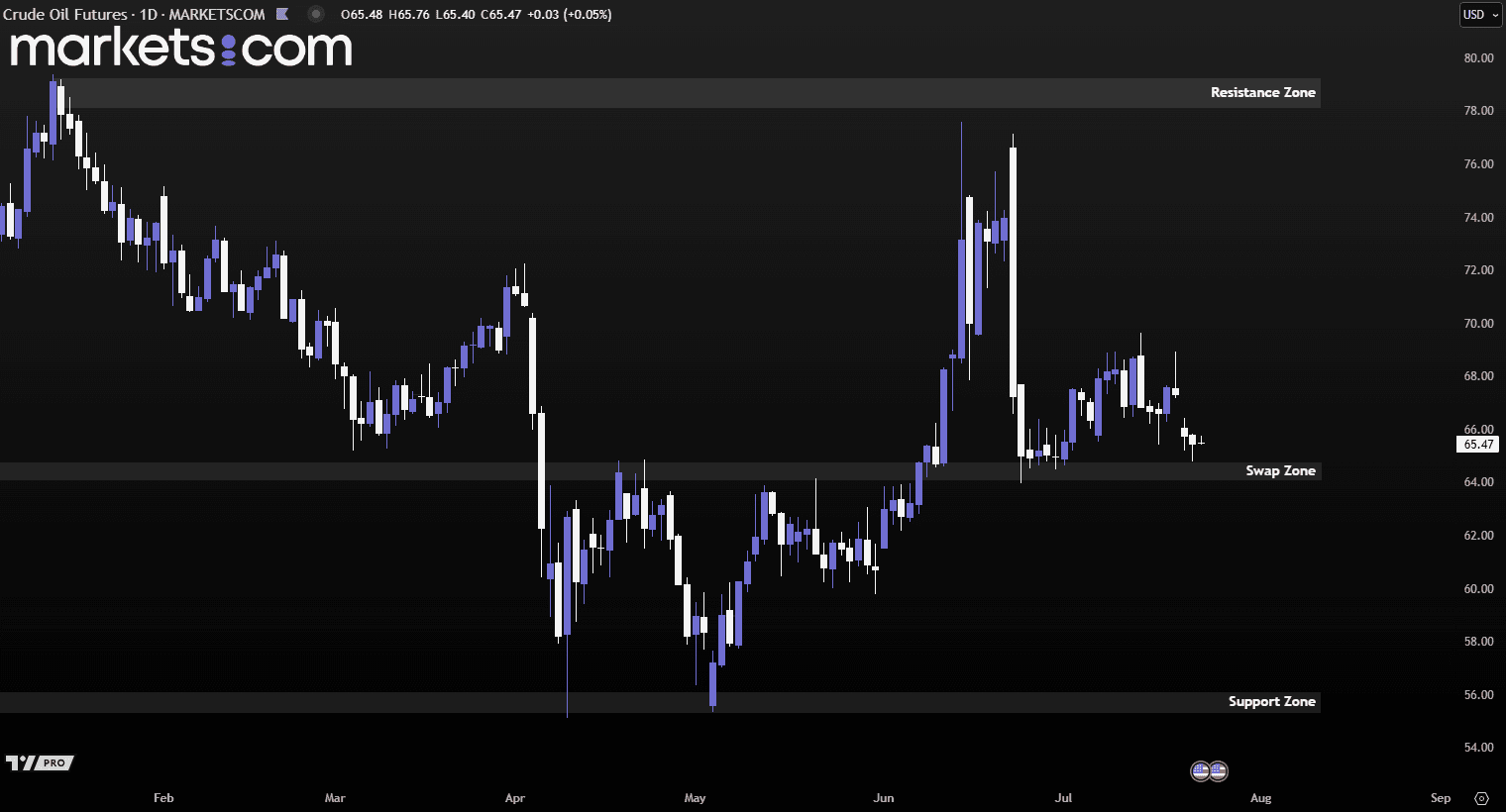

(Crude Oil Futures Daily Chart, Source: Trading View)

From a technical analysis perspective, crude oil futures have been retesting the swap zone at 64.10 – 64.70 in the near term. This zone serves as a key level for determining the next directional move. If the price finds support here and rallies with strong bullish momentum, it could potentially continue moving higher. Conversely, if the zone fails to hold, the price may drop further to retest the support area at 55.30 – 56.10.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed as investment advice.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.