You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

วันพุธ Jul 23 2025 09:28

9 นาที

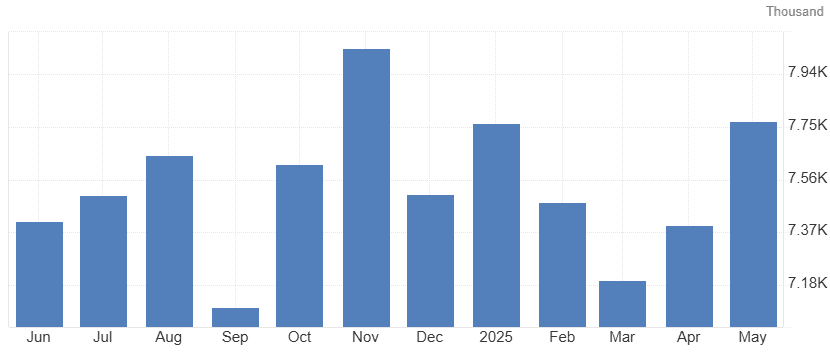

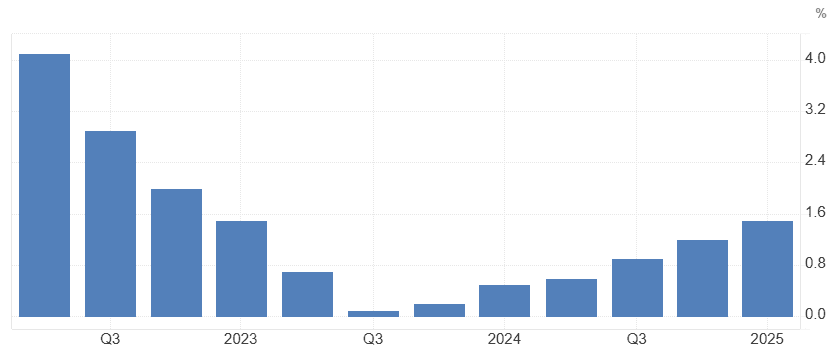

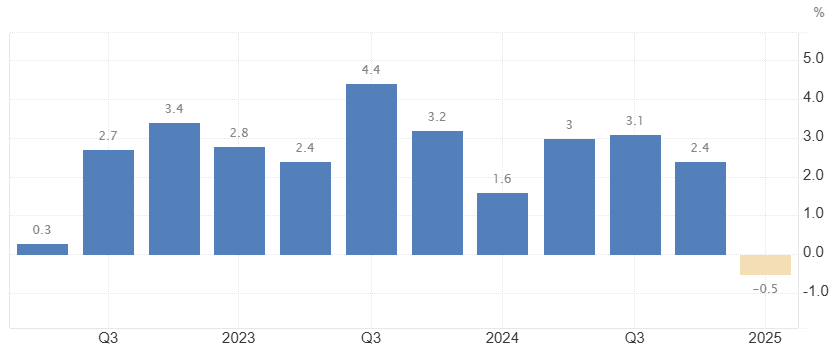

The U.S. JOLTs job openings for May stood at 7.769 million, with June’s figure (due 29 July, 1400 GMT) expected to fall to 7.1 million, signalling a cooling labour market under tight Fed policy. On 30 July, markets awaited the Eurozone Q2 GDP Flash (0900 GMT), U.S. Q2 GDP Advance (1230 GMT), BoC rate decision (1345 GMT), and Fed rate decision (1800 GMT). Eurozone growth is forecast to slow to 1.2% YoY, while U.S. GDP is expected to rebound to 3.5% QoQ. Both central banks are expected to keep rates steady as they assess inflation and economic momentum.

On 31 July, the BoJ is projected to hike rates from 0.5% to 0.75% (0300 GMT) amid rising inflation, while the U.S. Core PCE (1230 GMT) is expected to rise just 0.1% MoM, pointing to easing price pressures. The week wraps up with China’s Caixin PMI (1 August, 0145 GMT), forecast at 50.8, and the U.S. unemployment rate (1230 GMT), expected to tick up to 4.2%, reflecting gradual labour market softening. Key earnings from Visa, P&G, Microsoft, Meta, Apple, and Amazon also highlight the week.

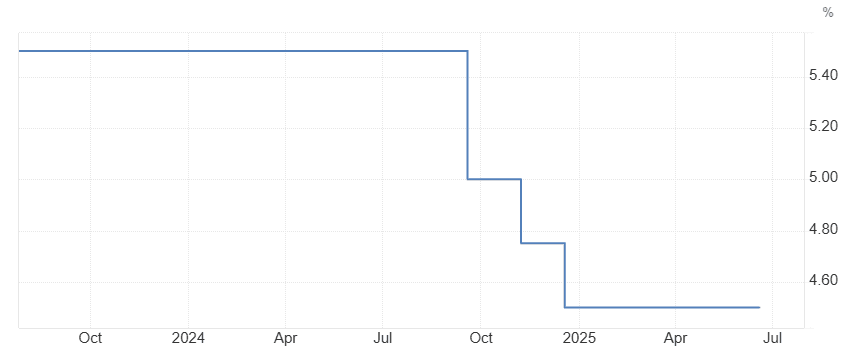

The U.S. JOLTs job openings came in at 7.769 million for May, while the expected figure for June is lower at 7.1 million. This anticipated decline reflects signs of a cooling labour market as the Federal Reserve’s prolonged period of high interest rates continues to weigh on business sentiment and hiring activity. Companies, especially in rate-sensitive sectors such as technology and manufacturing, are becoming more cautious, while slowing consumer demand and broader economic uncertainty are also contributing to a decline in job vacancies. This data is set to be released on 29 July at 1400 GMT.

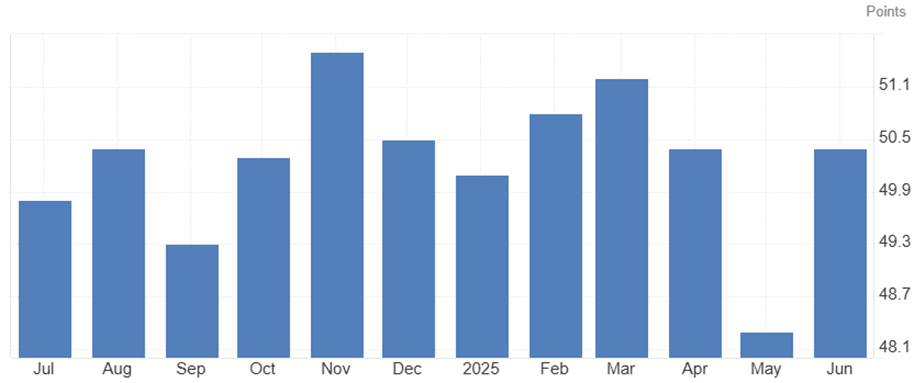

( U.S. JOLTs Job Openings Chart, Source: Trading Economics)

Top US company earnings: Visa A (V), P&G (PG)

The Eurozone’s year-on-year GDP growth rate for Q1 came in at 1.5%, while the flash estimate for Q2 is expected to slow to 1.2%. The expected moderation reflects persistent economic headwinds, including subdued consumer spending and weak business investment. Additionally, external demand remains subdued due to weaker global trade conditions, particularly with key partners like China and the U.S., further dampening economic momentum. This data is set to be released on 30 July at 0900 GMT.

( Eurozone GDP Growth Rate YoY Flash Chart, Source: Trading Economics)

The U.S. quarter-on-quarter GDP growth rate (advance estimate) showed a contraction of -0.5% in Q1, while the expected figure for Q2 is a sharp rebound to 3.5%. This optimistic forecast reflects stronger consumer spending, resilient labour market conditions, and a recovery in business activity following temporary disruptions in Q1, such as adverse weather, inventory adjustments, or seasonal effects. Additionally, robust retail sales and improving manufacturing output in recent months have supported expectations of a solid economic bounce-back in the second quarter. This data is set to be released on 30 July at 1230 GMT.

( U.S. GDP Growth Rate QoQ Advance Chart, Source: Trading Economics)

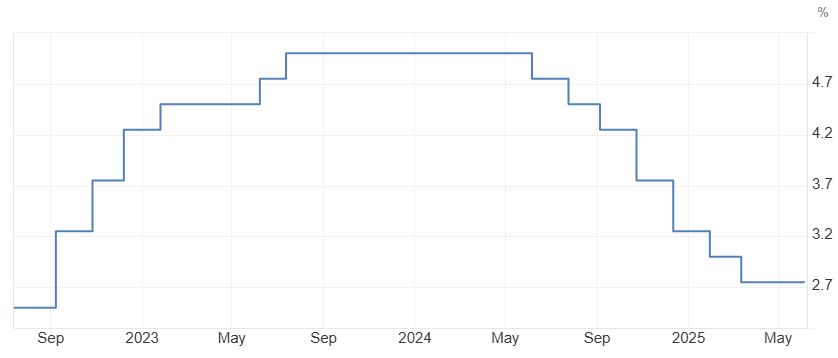

The Bank of Canada (BoC) kept its benchmark interest rate at 2.75% in its last decision, and the upcoming decision on 30 July at 1345 GMT is also expected to maintain the rate at 2.75%. This steady forecast reflects the central bank’s cautious approach amid signs of slowing inflation and mixed economic data. While price pressures have eased, the BoC remains vigilant about underlying inflation trends and wage growth. Holding the rate steady allows policymakers to assess the effects of recent rate cuts while avoiding unnecessary strain on households and businesses in a still-fragile economic environment.

( BoC Interest Rate Decision Chart, Source: Trading Economics)

The Federal Reserve maintained its benchmark interest rate at 4.5% in its most recent decision, and the upcoming decision on 30 July at 1800 GMT is also expected to hold steady at 4.5%. This unchanged outlook reflects the Fed’s data-dependent approach as inflation continues to gradually cool while the labour market remains resilient. With price pressures easing but not yet fully anchored, policymakers are likely to adopt a wait-and-see stance to assess the cumulative effects of previous rate hikes. Holding rates steady allows the Fed to balance the risks of under-tightening against the potential harm of overtightening in a moderating economic environment.

( Fed Interest Rate Decision Chart, Source: Trading Economics)

Top US company earnings: Microsoft (MSFT), Meta Platforms (META)

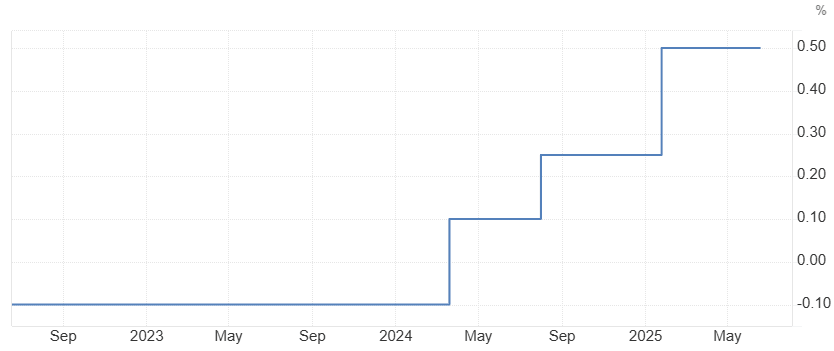

The Bank of Japan (BOJ) raised its benchmark interest rate to 0.5% in its last decision, and the upcoming decision on 31 July at 0300 GMT is expected to increase the rate further to 0.75%. This anticipated hike reflects the BOJ’s gradual shift away from its ultra-loose monetary policy, driven by rising inflation and stronger wage growth. With consumer prices staying above the central bank’s 2% target and domestic demand showing signs of improvement, policymakers are likely to continue normalising rates to prevent overheating and maintain price stability. The move also signals growing confidence in the sustainability of Japan’s economic recovery.

( BoJ Interest Rate Decision Chart, Source: Trading Economics)

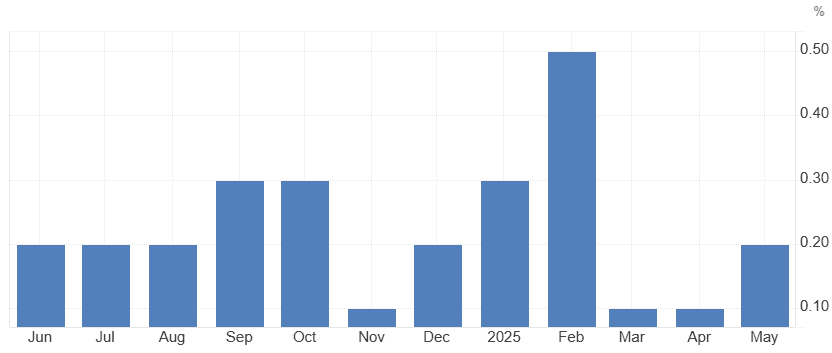

The U.S. core PCE price index rose by 0.2% month-on-month in May, while the expected increase for June is a more modest 0.1%. This anticipated slowdown reflects continued signs of easing inflationary pressures, particularly in core categories such as services and housing. As consumer demand softens and supply chains normalise, price growth is expected to decelerate further. The Federal Reserve’s tight monetary policy is also playing a key role in cooling demand, reinforcing expectations that core inflation will trend lower in the near term. This data is set to be released on 31 July at 1230 GMT.

( U.S. Core PCE Price Index MoM Chart, Source: Trading Economics)

Top US company earnings: Apple (AAPL), Amazon.com (AMZN)

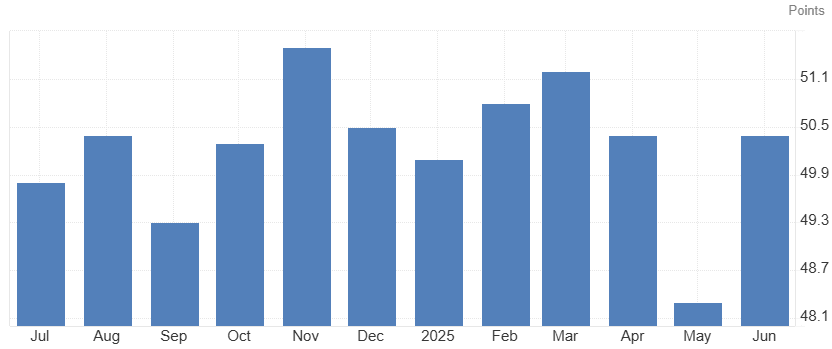

China’s Caixin Manufacturing PMI came in at 50.4 for June, and the July reading is expected to edge up to 50.8. This slight improvement reflects cautious optimism around stabilising factory activity, supported by modest government stimulus measures and recovering external demand. While overall momentum remains subdued, recent data suggests a gradual pickup in production and new orders. The expected rise above the 50-mark, which separates expansion from contraction, signals continued—though modest—growth in the manufacturing sector. This data is set to be released on 1 August at 0145 GMT.

( Caixin Manufacturing PMI Chart, Source: Trading Economics)

The U.S. unemployment rate stood at 4.1% in June, and it is expected to tick up slightly to 4.2% in July. This projected increase reflects signs of a gradually cooling labour market as the effects of the Federal Reserve’s tight monetary policy continue to weigh on hiring activity. Businesses, particularly in interest-sensitive sectors, are becoming more cautious amid economic uncertainty. While the labour market remains relatively strong, the slight uptick in the unemployment rate suggests that job creation is slowing, aligning with broader expectations of a soft landing for the U.S. economy. This data is set to be released on 1 August at 1230 GMT.

( U.S. Unemployment Rate Chart, Source: Trading Economics)

Top US company earnings: Exxon Mobil (XOM), Chevron (CVX)

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.