Friday Jul 25 2025 08:40

5 min

Gold is trading near $3,365 per ounce on Friday after two consecutive sessions of losses. Market participants are closely watching tariff talks, with the U.S. and EU reportedly nearing a deal, following a separate agreement between Washington and Japan. On the macro front, U.S. jobless claims declined for the sixth consecutive week, the longest such streak since 2022, signalling continued labour market strength.

This reinforces expectations that the Federal Reserve will keep interest rates unchanged at its next meeting. Markets are now pricing in fewer than two rate cuts for 2025, with the first fully expected in October. Meanwhile, tensions resurfaced between President Trump and Fed Chair Powell, this time over the central bank’s renovation expenses, adding a political twist to the monetary outlook.

From a technical analysis perspective, gold has recently rebounded from the support zone of 3,230 – 3,250, pushing the price up to retest the resistance zone at 3,425 – 3,445. However, bearish pressure rejected the breakout attempt, driving the price lower toward the order block at 3,333 – 3,350. If bearish momentum persists and breaks below this order block, gold may potentially continue its downward movement and move lower.

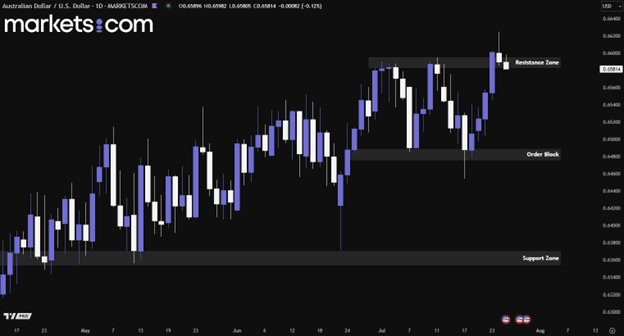

The Australian dollar declined to around $0.658 on Friday at the time of writing during the Asian trading session, extending losses from the previous session as traders turned cautious ahead of next week’s key inflation data. Both monthly and quarterly inflation figures are expected and could significantly influence the Reserve Bank of Australia's (RBA) monetary policy stance. RBA Governor Michele Bullock recently reiterated that the central bank would not rush to cut interest rates without stronger evidence that inflation is sustainably returning to its 2.5% target, reinforcing the RBA’s measured approach.

In parallel, investors are also monitoring developments in US-Australia trade relations. In a recent move, Australia agreed to ease restrictions on US beef imports, a decision that comes amid lingering tensions over past trade barriers. Despite the recent two-day pullback, the Australian dollar remains on track for notable gains overall for this week so far.

From a technical analysis perspective, the AUD/USD currency pair has been in a bullish trend since early April 2025, as evidenced by a series of higher highs and higher lows. Recently, the pair was rejected from the resistance zone of 0.6580 – 0.6595, showing signs of bearish momentum. If today’s candlestick closes decisively below this resistance zone, it could potentially trigger further downside movement.

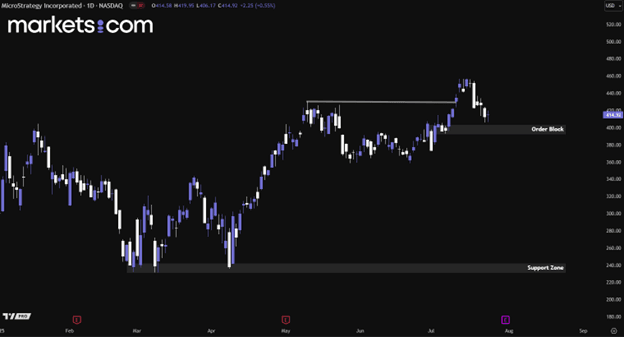

Strategy has long been recognised as one of the largest Bitcoin holders, setting a precedent that inspired many firms around the world to adopt a similar approach. The company recently announced an ambitious plan to accelerate its Bitcoin acquisitions, targeting a total of 1 million BTC. According to a new Bloomberg report, Strategy is stepping up its efforts by increasing its latest stock offering from $500 million to $2 billion.

From a technical analysis perspective, MSTR has been in a bullish trend since April 2025, after rebounding from the support zone of 231 – 243, as indicated by the formation of higher highs and higher lows. Recently, bullish momentum pushed the price above the previous high at the 430 level, but it has since pulled back and may potentially retest the order block between 392 – 402. If the price finds support in this zone, the bullish trend may resume, leading to a higher move.

What makes this development unusual is the lack of official updates from Strategy or its executive chairman, Michael Saylor, despite both being active on social media. The most recent press release still references the initial $500 million raise and was published days ago. Meanwhile, Strategy continues to lead global Bitcoin purchases, outpacing numerous competitors in the race for crypto dominance.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed as investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.